tax break refund calculator

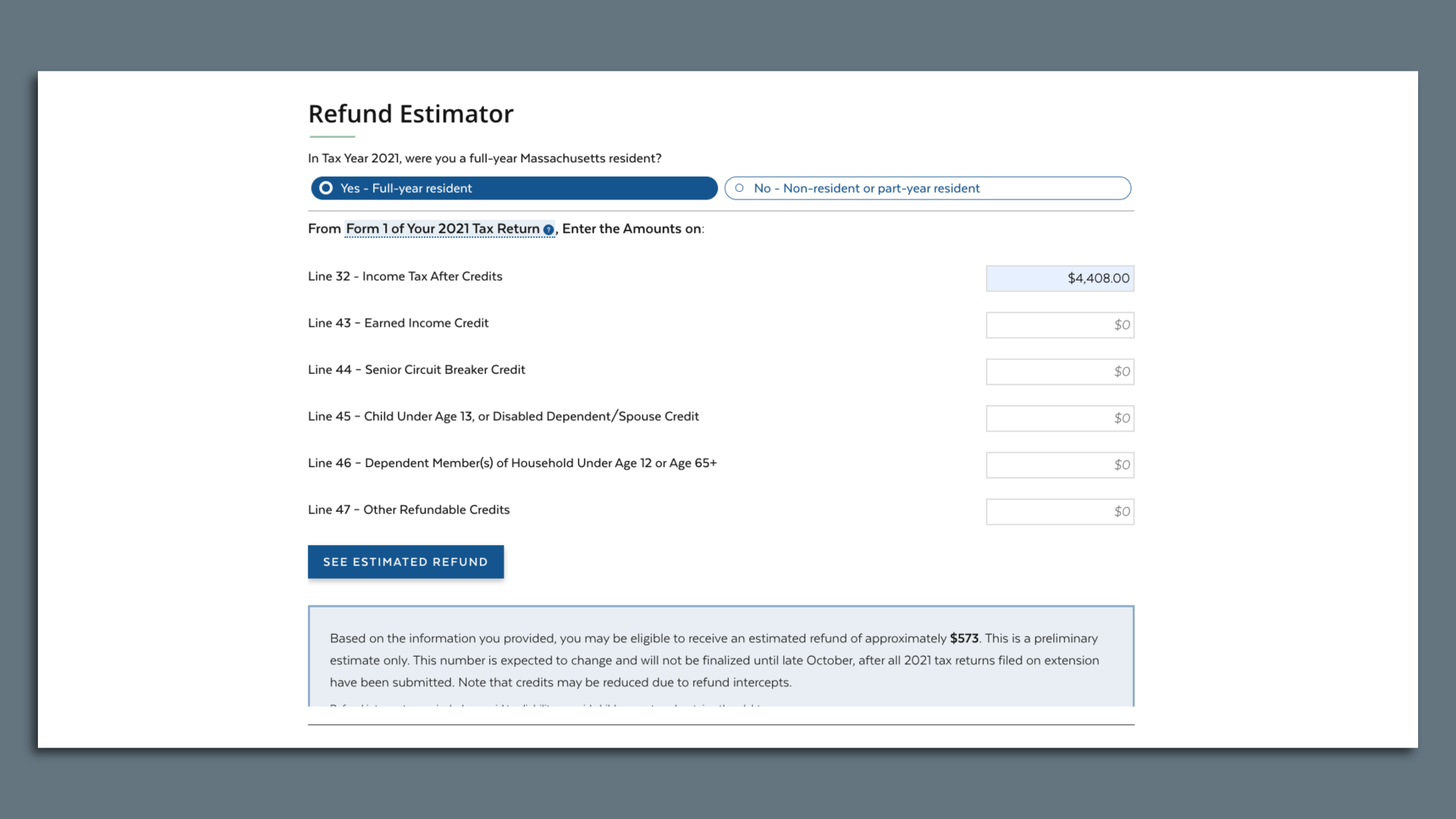

That means that in general taxpayers will receive a refund that is approximately 13 of their personal income tax liability in Massachusetts in Tax Year 2021. And is based on the tax brackets of 2021.

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

10200 x 012 1224.

. If you are eligible you will automatically receive a payment. This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available. Youll fill out basic personal and family information to determine your filing status and claim any dependents.

Once you have a good idea of your taxes or if you just want to get your taxes done with start with a free Taxpert account and file federal and. Up to 10 cash back Our tax refund calculator will do the work for you. Again whipping out the calculator gives us.

You can also create your new 2022 W-4 at the end of the tool on the tax. WASHINGTON To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this. This calculator is for 2022 Tax Returns due in 2023.

1 day agoThe jackpot for Saturday nights drawing is now the largest lottery prize ever at an estimated 16 billion pretax if you were to opt to take your windfall as an annuity spread. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. Up to 10 cash back Estimate your tax refund using TaxActs free tax calculator.

It is mainly intended for residents of the US. This percentage is a. The Middle Class Tax Refund MCTR is a one-time payment to provide relief to Californians.

You have until April 15th each year to file. Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that. This means they fall in the 12 tax bracket.

The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their. If youre married each. This applies even if you are not expecting to receive a refund.

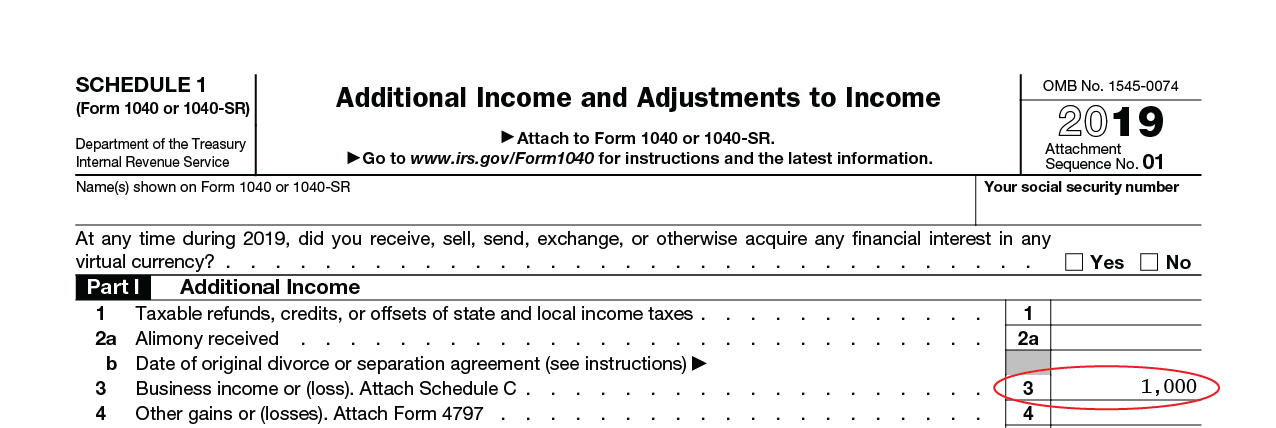

Start the TAXstimator Then select your IRS Tax Return Filing Status. You may qualify for the tax break up to 10200 of unemployment compensation if your modified adjusted gross income is less than 150000 for 2020. Remember this is for federal level only.

IR-2021-71 March 31 2021. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. If you are paid as a contractor you may receive compensation on a 1099-MISC form.

To be eligible you must have paid personal income taxes in Massachusetts in the 2021 tax year and filed a 2021 state tax return on or before October 17 2022. See how income withholdings deductions and credits impact your tax refund or balance due.

Tax Calculator Estimate Your Taxes And Refund For Free

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Tax Liability What It Is And How To Calculate It Bench Accounting

How To Calculate Your Federal Income Tax Liability Personal Finance Series Youtube

Tax Calculator Refund Return Estimator 2022 2023 Turbotax Official

What You Need To Know About Gi Bill Benefits And Tax Deductions

Federal Income Tax Return Calculator Nerdwallet

Coronavirus Covid 19 Its Impact On Your Taxes H R Block

How To Calculate Your Projected Massachusetts Tax Rebate Axios Boston

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Get Your Maximum Tax Refund Credit Com

![]()

Tax Refund Estimator Free Budget Calculator

:max_bytes(150000):strip_icc()/GettyImages-1131866817-af3bb858b38b4518bd77332c8c60ab66.jpg)

Tax Deductions And Credits Guide

Covid Bill Changes Tax Rules Midstream How To File An Amended Return

Here S What To Know On Tax Day If You Still Haven T Filed Your Return

Federal Tax Filing Season Has Started Coastal Wealth Management

How To Calculate Earned Income For The Lookback Rule Get It Back

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Received Jobless Benefits In 2020 Irs Could Be Sending You Money Soon